sip rate of contribution

The growth percentage of your SIP investment the expected rate of return and the tenure of the investment. RFC 3311 SIP UPDATE Method.

From What Age Can Sip Be Started Quora

These investments at regular intervals for a pre-defined tenure show the power of compounding a small amount leading to a sufficient corpus in the future.

. It can be a percentage or a fixed sum in addition to the initial SIP contribution. Rate of Tax Under Equalisation Levy. MBA Marketing SIP Report 1.

Federal government websites often end in gov or mil. RFC 3262 Reliability of Provisional Responses for SIP. However a sizeable number of individuals are still confused about SIPs.

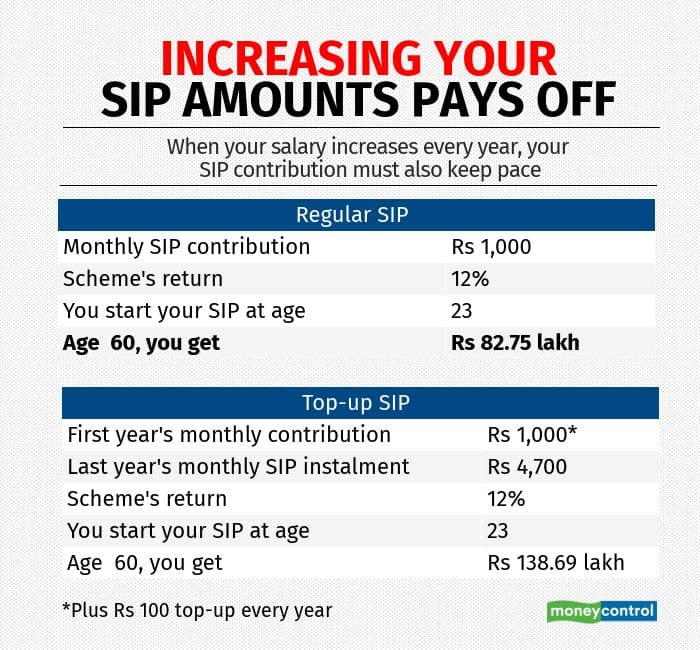

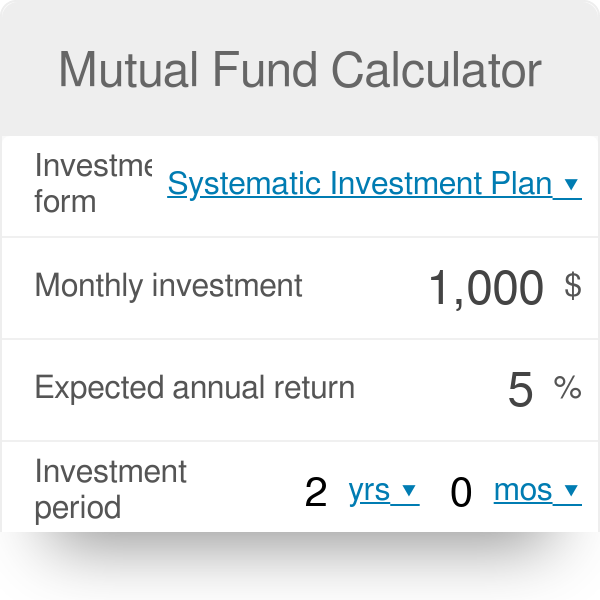

Sensex has given 10 return from 2010 - 2020. The SIP contribution calculator needs the final target amount step-up if any CAGR return annually time period date of SIP etc as the inputs to calculate the target monthly SIP contribution. This step-up SIP calculator easily predicts the value of your growing SIP investment.

A minimum amount of Rs 500 for NPS Tier-I account and a minimum amount of Rs 1000 for NPS Tier-II account. However the tax rate varies as per the type of fund. Before sharing sensitive information make sure youre on a federal government site.

Why should you set an SIP SIP allows you to invest in a disciplined and phased manner assisting you in building a retirement corpus. Enhanced Sip Guidebook 1. If the top-up option isnt available you can simply start a new SIP in the same fund.

Once you apply for one or more SIP. Due Dates for Compliance. SP BSE SENSEX first compiled in 1986 was calculated on a Market Capitalization-Weighted methodology of 30 component stocks representing large well-established and financially sound companies.

You can start an SIP with a frequency of your choice. An SIP is a simple tool that helps you to invest regularly in mutual funds. RFC 3863 Presence Information Data Format PIDF.

Rohan has advertised on Facebook to expand his business. SIP Calculator helps you to calculate the returns on your monthly SIP investments. Expert guides and analysis for UK and global business.

Returns from mutual fund SIP arent tax-free. On the mutual fund step-up calculator enter the tenure or time you would like maturity. Expected rate of return in Year.

He has to pay Rs. RFC 3856 A Presence Event Package for SIP. News tips updates and advice.

Currently the applicable rate of tax is 6 of the gross consideration to be paid. To use the D-Remit to Trustee Bank facility please use RTGSNEFTIMPS as the mechanism of remittance. The Occupational Pension Schemes Investment Regulations 2005 set out the requirements for what must be included in a SIP but you may include additional information as appropriate for your members.

SIP investments are generally for a fixed period of 1 year 3 years or 5 years. Please keep in mind that the minimum contribution amount through the D-Remit option is Rs. In other words the new interest rate announced will be valid from 1st April of one year to the year ending on 31st March of next year.

Even though returns on SIP mutual funds entirely depend on the market performance the above is the list of top-performing best SIP plans for the year 2022 wherein you can consider investing. Number and rate of dropouts by. We would like to show you a description here but the site wont allow us.

This helps you to skip some payments when there is a cash crunch and you can also make more contribution to your SIP account when there are. An investor is required to make an initial contribution at the time of registration. BENEFIT CALCULATOR SIP Note.

Your contribution in planning and implementing the SIP and AIP should be included in the Results-based Performance Management System RPMS. Get the rough estimate of SIP returns invest in the best SIP Plan now. Daily weekly monthly quarterly among.

RFC 3711 The Secure Real-time Transport Protocol SRTP RFC 3640 RTP Payload Format for Transport of MPEG-4 Elementary Streams. RFC 3428 SIP Extension for Instant Messaging. Likewise you can make a bigger contribution to your SIP account when you receive a bonus or an additional income.

Nilesh Gokhale Name of the faculty. Moreover the interest is calculated monthly but. The purpose of the SIP is to set out your investment strategy including the investment objectives and the investment policies you adopt.

SIP investment plan is about investing a small amount over time rather than investing one-time huge amount resulting in a higher return. The contribution towards SIP helps the investors to manage their investment regularly in a simple and hassle-free way. A pocket-friendly amount invested in your SIP account leads to a handful corpus at the time of need because of the disciplined regular contribution.

500 for both Tiers. In case of private sector. As of February 1 2022 UTC Flowroute may assess an E911 fee used to recover legal and regulatory charges arising from Flowroutes compliance with the Ray Baums Act including increased state and local taxes on E911 services.

How does SIP work. 200000 in FY 2020-21 to Facebook for the advertising services availed. You can also factor in the effect of inflation when using the SIP calculator online though not explicitly.

This calculation only applicable to Loss of Employment LOE happened before 1st January 2021For LOE starting from 1st January 2021 until 30th June 2022 click HERE to calculate your benefit. School awards and recognitions PERFORMANCE INDICATORS ACCESS 7. You could do this by.

Many of them do not know how really an SIP works. For equity funds short term capital gains are taxable at 15 per annum. The EPF interest rate of a financial year is set at the end of a financial year.

Currently only central government employees are eligible to claim tax benefit of 14 for the employers contribution to the NPS account of an employee. MIT SCHOOL OF MANAGEMENT Page 1 A Summer Project Report On Marketing Activities Customer Response for Hypercity At Hypercity Retail India Ltd Pune Swargate By Dharmendra Kumar Yadav MBA-II Marketing Batch -2015-17 Under the guidance of Prof. Employees of state governments will be able to claim a tax benefit of 14 on the NPS contribution made by their employer ie state government from FY 2022-23 onwards.

Measuring returns of SIP using the Step-Up SIP Calculator is easy and you need to follow the below-mentioned steps. How to Use Groww Step Up SIP Calculator. The minimum contribution for subsequent contributions depends on the account type opted by investors ie Tier-I account or Tier-II account.

Assuming a certain rate of return and SIP contribution. Note for School Heads teachers and staff. The gov means its official.

Enter the monthly contribution of the fund. Several individuals do not know how to start an SIP. Benefits are calculated based on your previous assumed salary and your Contributions Qualifying Conditions CQC ie.

The Rupee Cost Averaging Factor. Systematic Investment Plan SIP is a method of investing in mutual funds wherein an investor chooses a mutual fund scheme and invests a the fixed amount of his choice at fixed intervals. The current EPF interest rate for the Financial Year 2021-22 is 810.

Lump Sum Sip Calculator Financeplusinsurance

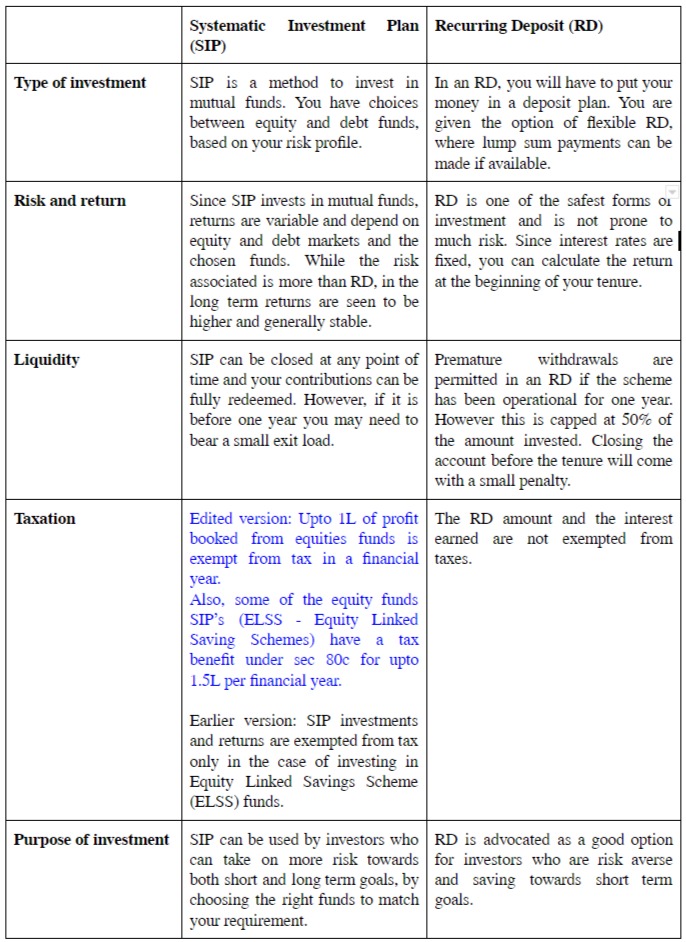

Key Differences Between Sips And Recurring Deposits Immpl

To What Extent Or Percentage Of Our Salary We Should Invest Through Sip Quora

Sip With A Twist Fintech Platforms And Mutual Funds Tweak The Plain Old Sip Is It Worth It

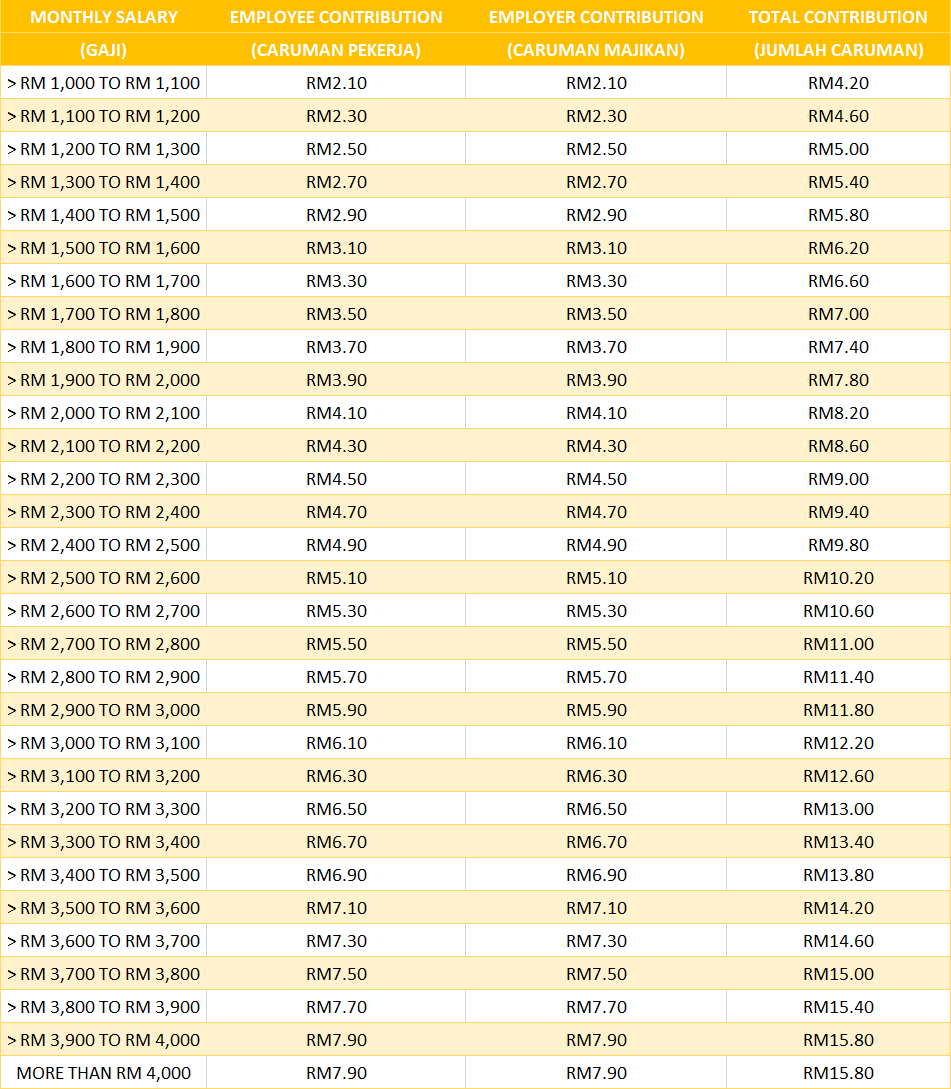

Eis Perkeso Eis Contribution Table Eis Table 2022

Building Wealth Banker On Fire

From What Age Can Sip Be Started Quora

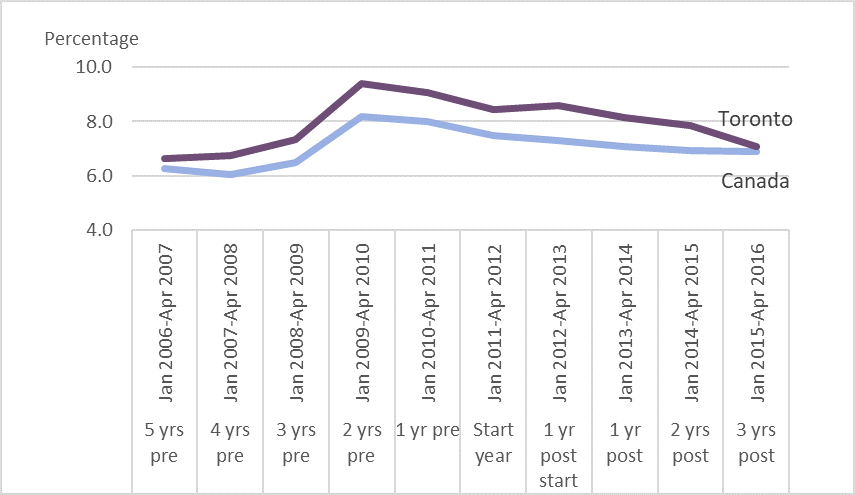

Chapter 3 Impact Of Effectiveness And Employment Insurance Benefits Ebsms Part Ii Of The Employment Insurance Act Canada Ca

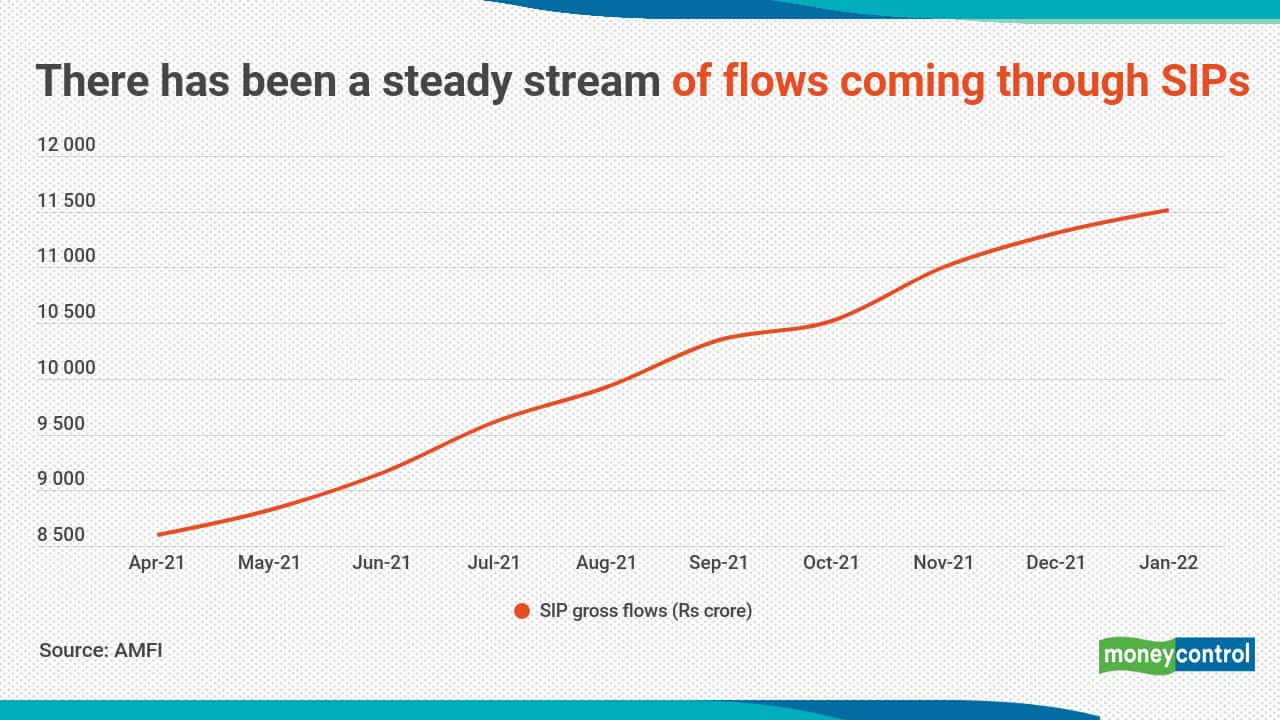

How Sips Became The Most Popular Mode Of Investing In Mutual Funds

Sip Calculator Systematic Investment Plan

Invest The Right Sip Amount Systematic Investment Plan Investing Investment Business Ideas

No comments for "sip rate of contribution"

Post a Comment